Participating in Glow

Glow Mining and Delegation are two ways that Glow's community participates in the protocol's competitive solar economy. These roles form the capital backbone that enables new solar farms to join the protocol and earn rewards. For a detailed overview of how these roles interact, see our blogpost: The Three Pillars of Glow Solar Mining.

Glow Miners pay cash incentives to Solar Farm Installers for onboarding competitive solar farms. In exchange, they receive a portion of GLW tokens that the farm earns over its lifetime, splitting these rewards with Glow Delegators. Mining positions are purchased with USDC on the Mining Center, and tokens accumulate over 100 weeks.

Glow Delegators provide the protocol deposits required for farms to join Glow. In return, they earn rewards from two sources: deposit recovery based on farm performance, and a share of GLW protocol emissions allocated by Glow Miners. The combination of these two streams is what ultimately makes delegation the most capital-efficient use of GLW tokens.

However, delegation requires holding GLW tokens. For new entrants to Glow who have assets like USDC or ETH, there are generally two paths to GLW ownership: purchasing GLW at spot on the Uniswap v2 pool at app.glow.org, where tokens are immediately available for delegation, or purchasing mining positions, where GLW accumulates over time (typically 100 weeks). Many participants combine both approaches and use spot purchases for immediate delegation while building additional holdings through mining.

One strategy occasionally seen within the ecosystem is for GLW holders to sell their tokens for USDC to purchase mining positions. This article explains why that conversion often leaves value on the table, and why delegation, which preserves capital rather than consumes it, remains the more efficient path for those who already hold GLW.

Delegation Economics

Delegation allows GLW holders to maintain their exposure to GLW while productively utilizing their tokens to support new solar farms and earn compounding rewards. These rewards come from two distinct sources over 100 weeks, each with different characteristics that together create a balanced composite reward stream.

The first stream is deposit recovery and surplus capture. When Delegators post protocol deposits for solar farms, they earn those deposits back based on the farm's competitive performance. Farms that are more competitive than the regional average recover deposits faster and capture surplus from weaker competitors. Farms that underperform recover deposits more slowly and forfeit some value to high performers. This competitive landscape shifts slowly as farms innovate through operational improvements and location optimizations, meaning deposit recovery rates tend to be predictable week over week.

The second stream is protocol emissions. The protocol mints 175,000 GLW tokens each week and distributes them across all active farms. A farm's share of this fixed pool depends on the total number of farms competing for rewards. As more farms join the protocol, each existing farm's share of emissions is proportionally diluted.

The two streams have different characteristics. Deposit recovery depends on a farm's competitive position relative to regional peers, a landscape that shifts gradually as farms optimize operations. Protocol emissions, by contrast, dilute as more farms join the network and compete for a fixed weekly token allocation. Delegators holding both streams benefit from the relative stability of deposit recovery while also capturing emissions upside.

Mining Economics

Mining positions offer a different value proposition. Purchasing a mining position on the Mining Center allows participants to pay USDC or ETH upfront and accumulate GLW over time. This is generally a favorable trade for participants who want to use their USDC or ETH to acquire GLW. However, Miners are not guaranteed any specific amount of GLW: since mining rewards come exclusively from protocol emissions, the amount of GLW a Miner earns can dilute significantly if many new farms join the protocol.

Mining is attractive for participants who want to accumulate GLW over time and are comfortable trading immediacy for a potentially lower cost of acquisition. The Mining Center offers opportunities where cash incentives have already been paid to Solar Farm Installers and reward splits with Delegators have been finalized. Participants purchase mining positions with USDC or ETH and immediately begin receiving weekly GLW distributions from farms that are already live and active on Glow.

The key distinction is that mining position rewards stem only from protocol emissions (albeit a larger share of emissions than Glow Delegators). Therefore, mining is ideal for participants with USDC or ETH who want to build a GLW position over time. However, for those who already hold GLW, selling it to buy miners means giving up existing tokens in hopes of earning them back through emissions, which is a substantially less effective and riskier path for sustained token accumulation.

Why Selling GLW to Buy Miners Is Inefficient

Consider a holder with GLW tokens worth $10,000. If they delegate those tokens directly, they post the GLW as a protocol deposit and over 100 weeks, they earn that deposit back through the deposit recovery mechanism, plus they receive their share of protocol emissions on top. The GLW they started with returns to them (potentially more if the farm is competitive), and the emissions are pure upside on their existing GLW token position. Crucially, if many new solar farms join the protocol during those 100 weeks, the Delegator still recovers the same GLW they deposited. Deposit recovery will never be diluted by protocol growth as long as the Delegator's farm remains competitive.

If instead they sell their GLW for $10,000 USDC and purchase mining positions, the economics are entirely different, since the holder has completely exited their GLW position. Mining positions earn only protocol emissions, which accumulate as GLW over 100 weeks. When the protocol grows and many new farms join, those emissions get diluted across more participants, and the Miner receives less GLW than they might have expected. The token holder is now attempting to rebuild their GLW position from zero through a single reward stream that shrinks as the protocol succeeds and grows. Mining makes sense for someone converting USDC or ETH into GLW over time. But for those who already hold GLW, delegation lets them keep their position and build on it regardless of how many farms or regions join Glow. Selling to mine means starting over and betting that the protocol does not significantly grow over a two-year time horizon.

Someone who mines by selling GLW risks being left behind as the protocol succeeds, while someone who takes their GLW and delegates it is not. If Glow succeeds, that means more farms joining, more regions coming online, and sustained protocol growth. Miners face a real risk of their rewards diluting as the protocol expands, whereas Delegators do not face that same risk because deposit recovery remains intact regardless of how many farms join. For GLW holders who believe in the protocol's success, delegation is the economically superior path.

Case Study from a Live Farm

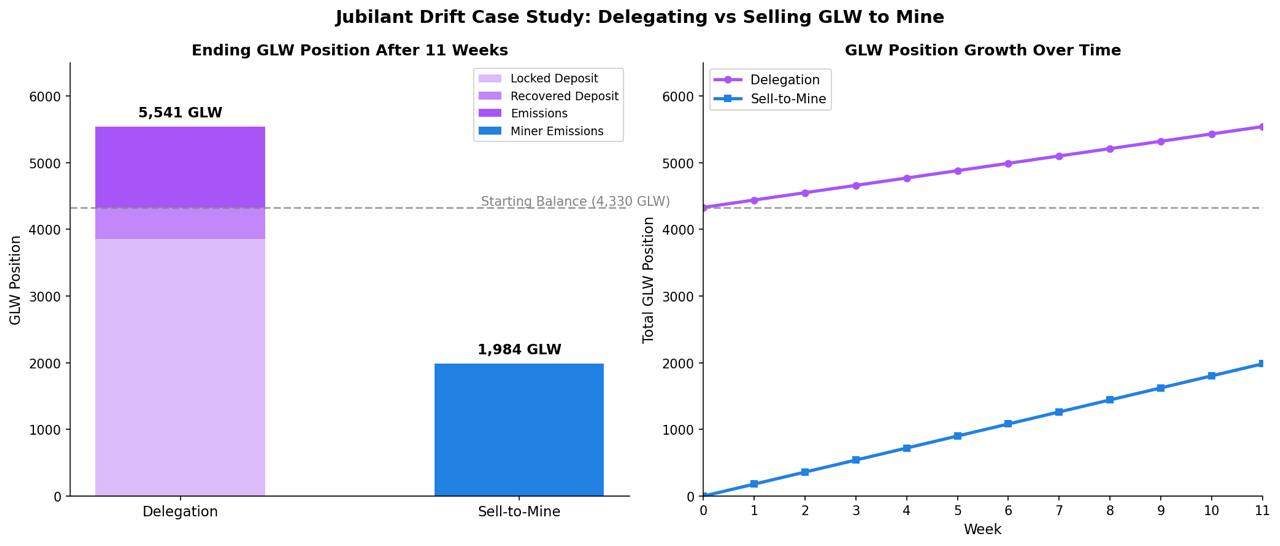

To illustrate the capital efficiency difference concretely, consider a case study using Jubilant Drift with 11 weeks of actual on-chain performance data. Starting with 4,330 GLW (valued at $1,299 at $0.30/GLW, exactly the cost of one mining piece), compare the two paths:

Delegation path: The 4,330 GLW is deposited. After 11 weeks, the Delegator has earned 1,211 GLW in emissions and recovered 476 GLW of their deposit. The remaining 3,854 GLW is still locked and continuing to recover. Total GLW position: 5,541 GLW.

Sell-to-mine path: The 4,330 GLW is sold for 1,299 USDC, which purchases one mining piece. After 11 weeks, the Miner has earned 1,984 GLW in emissions. The original 4,330 GLW is gone. Total GLW position: 1,984 GLW.

Figure 1. Left: Ending position breakdown after 11 weeks. Right: Position growth over time. Delegation preserves the starting 4,330 GLW and adds emissions on top; sell-to-mine starts from zero.

The Miner earns more raw emissions (1,984 vs 1,211 GLW), but the Delegator's total position is 2.8x larger because the deposited GLW is being recovered. The Delegator's position stays above the starting balance from week one, while the Miner's position starts near zero and grows to 1,984 GLW by week 11. Even after 11 weeks of earning higher weekly emissions, the Miner's total position is still 2,346 GLW below where they started.

Selling GLW to buy miners also carries an implicit bet on GLW price stability. If GLW increases significantly in price, more farms will join the protocol to capture the opportunity. As more farms join, the fixed weekly emission pool gets split among more participants, diluting everyone's weekly rewards.

Consider what happens if GLW suddenly 10x in price. The influx of new farms would dilute emissions to roughly 1/10th of their current level. The Miner who sold 4,330 GLW to buy mining positions would see their weekly emissions drop dramatically, making it nearly impossible to rebuild their original position. The Delegator, by contrast, still recovers their 4,330 GLW through deposit recovery regardless of how many new farms join. Emissions dilute for both paths, but only the Delegator preserves their principal.

Selling GLW to buy miners is effectively a bet that GLW price won't increase substantially and that the number of farms won't grow significantly for a while. If that bet is wrong, the Miner's position erodes while the Delegator's principal remains intact. And even if the bet is right, delegation still captures steady emissions at current levels, plus deposit recovery and potential competitive surplus. The sell-to-mine path only outperforms if raw emission yields are high enough to overcome the loss of principal, which becomes increasingly unlikely as the protocol matures.

Choosing the Optimal Reward Pathway

For USDC holders looking to enter Glow, both mining and spot purchases are valid paths to GLW ownership. Mining offers discounted accumulation over time for those comfortable with a longer horizon, while spot purchases provide immediate tokens for those who want to start delegating right away. Many participants combine both approaches to balance immediacy with cost efficiency.

For those who already hold GLW, delegation is the clear choice. Converting GLW to USDC to buy miners trades away principal preservation for a single reward stream, and the mining discount is not designed to compensate for that loss. Delegation to competitive farms on the Launchpad is how GLW holders put their tokens to work most productively.