In Glow: The Human Era, David explains Glow’s foundational insight: tipping the scales of profitability means commanding the full strength of Capitalism.

That idea worked. A relatively small but targeted subsidy made solar energy more competitive, and over $20 million in deployments followed. The GLW subsidy directly incentivized the development of massive-scale clean energy infrastructure.

While effective, the first iteration of Glow was rigid in design. It targeted a single type of carbon credit, leaving little room for regional nuance or human input. The second iteration of Glow opens the protocol to multiple targets, each defined and directed by people who collectively choose where and how Glow’s subsidy mechanism should flow.

Glow Control (GCTL) is a new asset at the center of this shift. If GLW is the engine, then GCTL is the steering system. Each week, the protocol emits a fixed stream of GLW tokens to subsidize solar development, forming a flowing budget for infrastructure deployment. Each GCTL token grants its holder a permanent share of that budget, enabling GCTL owners to fund development in the regions and communities that matter to them.

GCTL is more than a coordination tool. It is a powerful, scarce asset with real utility and value. Holding it means gaining durable exposure to Glow’s core economic activity, and using it means shaping that activity on your own terms.

The GLW Token Subsidy

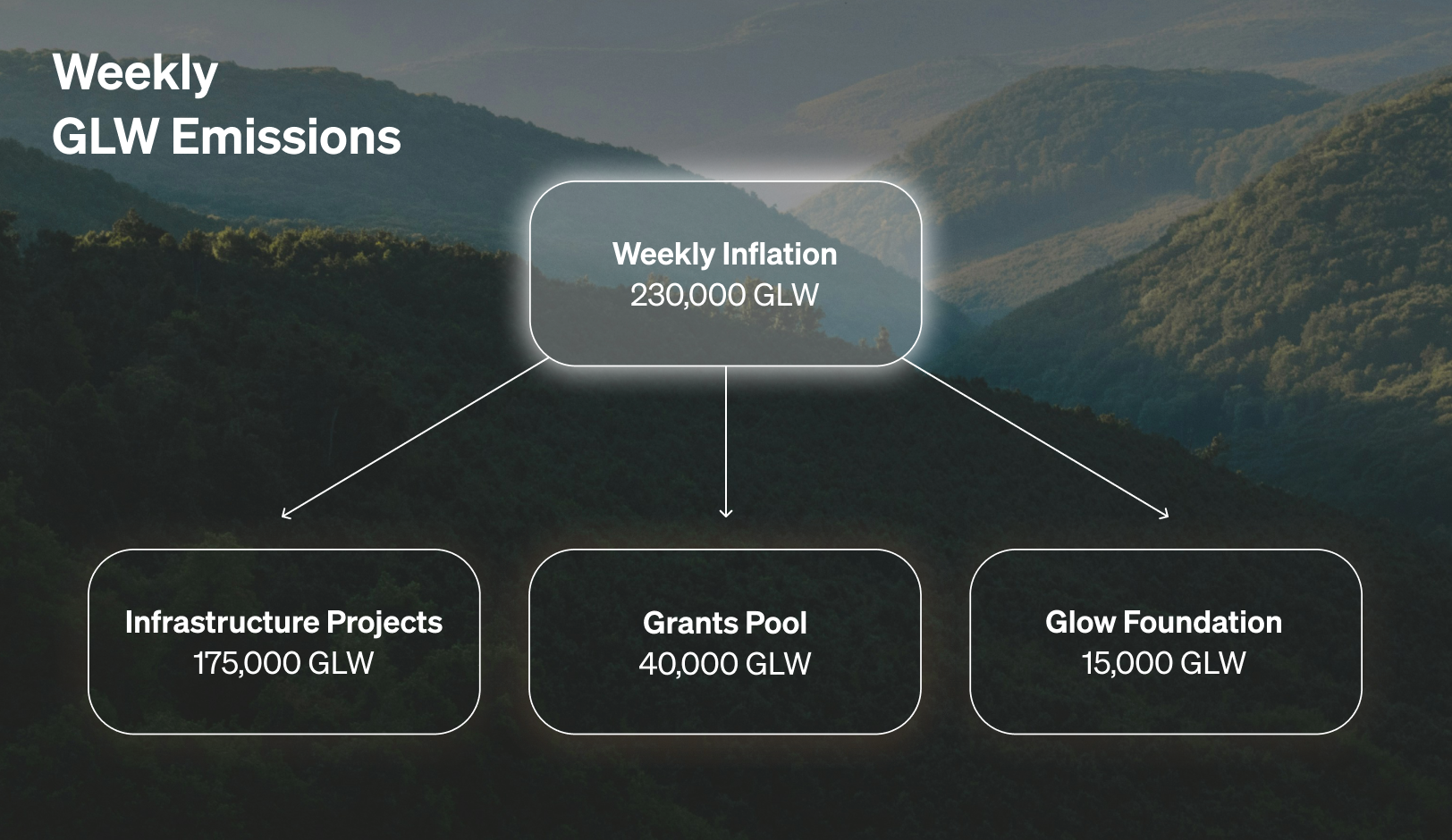

Glow is powered by the continuous issuance of its core token, GLW. Each week, the protocol emits 230,000 new GLW tokens. These tokens are directed as follows:

- 175,000 GLW to Infrastructure Projects

- 40,000 GLW to the protocol’s Grants Pool

- 15,000 GLW to the Glow Foundation for governance and operational support

Figure 1. GLW Weekly Emissions Allocation

The continuous weekly stream of 175,000 GLW allocated to Infrastructure Projects is the protocol's primary fuel.

GCTL: Allocating Capital and Funding What Matters

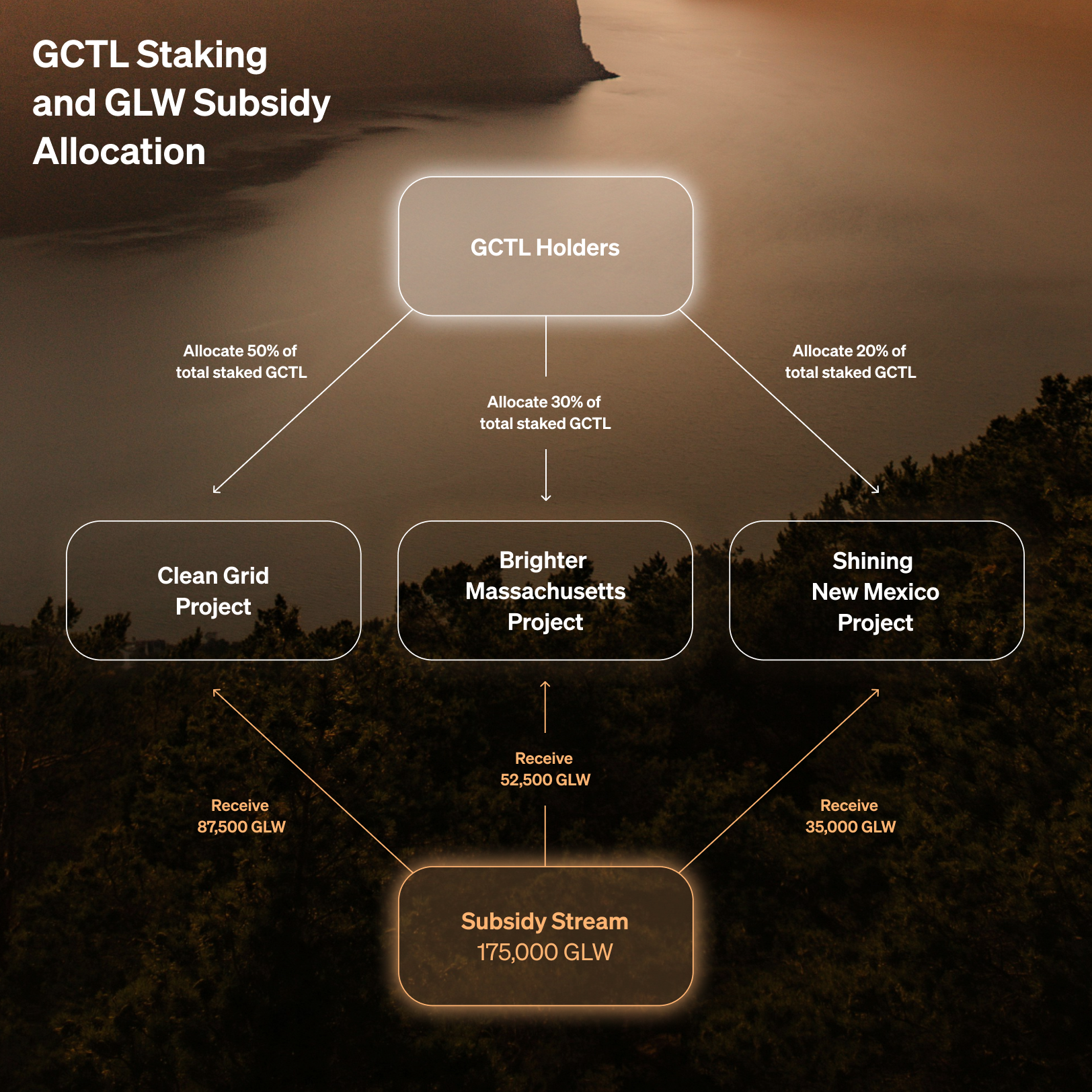

GCTL holders decide how to direct the steady stream of protocol rewards. More specifically, they allocate Glow’s ongoing subsidy flow toward active Infrastructure Projects. Each project defines how its solar farms are selected, verified, and rewarded.

The Clean Grid Project is the first Infrastructure Project on the new Glow protocol. What began simply as “Glow” now continues under the Clean Grid banner, a global effort to maximize carbon displacement by funding solar on fossil-heavy grids. As the system transitions into a GCTL-based model, the same logic remains, but now with new tools for directing capital.

Potential future projects, such as the hypothetical Brighter Massachusetts and Shining New Mexico projects, could follow the same foundational structure of Clean Grid, but narrow the geographic focus. In these cases, emissions reductions are localized to improve regional grids.

GCTL holders fund solar developments in their desired regions by staking their GCTL tokens to a region. Holding 1 percent of total staked GCTL grants control over 1 percent of the weekly GLW inflation, equating to 1,750 tokens per week that can be directed at the holder's discretion. GCTL owners can stake their tokens to any active Infrastructure Project, whether global in scope like Clean Grid, or more regional like Brighter Massachusetts.

Figure 2: Hypothetical GCTL Staking and Subsidy Allocation

GCTL is more than just a routing mechanism. It’s a productive asset with built-in utility.

For example, if a project like Brighter Massachusetts were live on Glow, a GCTL holder could stake their tokens to it, directing a share of GLW rewards to all solar farms that are live in the region.

GCTL staked to an Infrastructure Project can also be used to generate yield from the region's solar output. This yield may be GLW tokens or carbon credits, depending on whether stake is tied to specific farms or to the region as a whole. GCTL holders retain flexibility over their allocation, allowing them to both direct subsidies and participate in the value created by the solar infrastructure they help bring online.

GCTL is a durable, yield-bearing asset that lets holders shape capital flows, support infrastructure on their terms, and capture real returns from the value they help create. As more regions activate and new infrastructure comes online, demand for directional capital commensurately grows. GCTL is much more than just a governance token or subsidy router; it is a productive asset that turns belief into yield and intent into impact.

Acquiring GCTL

Minting Mechanics

The price to mint one GCTL token is equal to the square root of the price of GLW at the time of mint:

For example, if GLW is worth 9 USD, then one GCTL token costs approximately 3 USD to mint. If GLW is worth 100 USD, the mint price rises to about 10 USD. As GLW grows more valuable, it becomes more expensive to acquire GCTL.

Fortifying the GLW Network and Token

Each GCTL minted makes GLW more valuable, because all funds used to mint GCTL become liquidity that supports the GLW token price. Collectively, these funds are called the Glow Endowment.

The Glow Endowment manages its funds using a rebalancing strategy. At all times, half the value of the funds is kept as GLW tokens, and the other half is kept as stablecoins. This means that if the GLW token price decreases, the Glow Endowment will use its stablecoins to buy up GLW tokens. This also means that the Glow Endowment will always have a pile of GLW tokens, and that this pile grows any time GCTL is minted and any time the GLW price decreases.

The Glow Endowment effectively acts as a long-term holder that actively manages its funds to provide continuous, long-term support to the GLW ecosystem. Beyond just supporting the GLW token price, the Endowment creates a reliable source of liquidity for GLW token holders, ensuring that funds are available to trade GLW tokens in all market conditions.

The endowment even earns yields on the funds that it manages. Even if people are not minting GCTL, the Endowment continues to accumulate, reinforcing itself and increasing the protocol’s resilience. As more GCTL is minted the system becomes more robust: liquidity deepens, confidence builds, and price support strengthens, reinforcing a deep and symbiotic relationship between the GLW token and the GCTL token.

Coordinating Local Impact at Scale

Glow no longer imposes coordination around a single global priority. Instead, GCTL enables people to fund what they care about, in the places they know, with outcomes they can measure.

Each Infrastructure Project defines its own logic, rules, geographies, and verification systems. GCTL holders allocate capital towards regions that align with their priorities or create new ones to reflect outcomes not yet represented.

The result is a new model for infrastructure funding. Clean energy is deployed not by mandate, but by intention, and subsidies flow where people value them most. At the center of it is GCTL, a scarce and productive asset that gives holders the power to steer capital, shape outcomes, and earn returns from the infrastructure they help build.